Reducing Your Property Taxes

Appeal your property assessment: This is literally the approach that will - or will not - have the biggest impact on lowering your property taxes. It starts by contacting your local assessor's office and asking what you need to do to get a change in the assessed value of your property.

Research tax exemptions and credits: A number of local governments offer tax exemptions and / or tax credits. Again, you likely need to contact your local assessor to find out. Use the Search capability found on this site to search for the state / county and contact information.

Keep your property in good repair: A bit of a catch-22. Keeping your property in good shape means increasing the value of your property. This will likely not directly lower your property tax bill, but should make it easier to justify a higher selling price should you sell sometime in the future. If you receive more money for the sale, that helps offset the higher ongoing property tax you may have experienced.

Hire an expert: A savvy property tax consultant or attorney should be able to justify their cost by helping you negotiate a lower property tax bill.

Stay up to date: Tax rates can change each year. If your tax bill increases significantly - and especially if you have not increased the value of your property - check with the county assessor to see what you can do to reduce property taxes.

Know your home's value: Especially if your home's value decreases. You may very well have a good case for getting your taxes lowered. Again, contact your local assessor.

Check for errors: They happen. Check that the information on your property tax bill is accurate. If you find any errors, get it corrected.

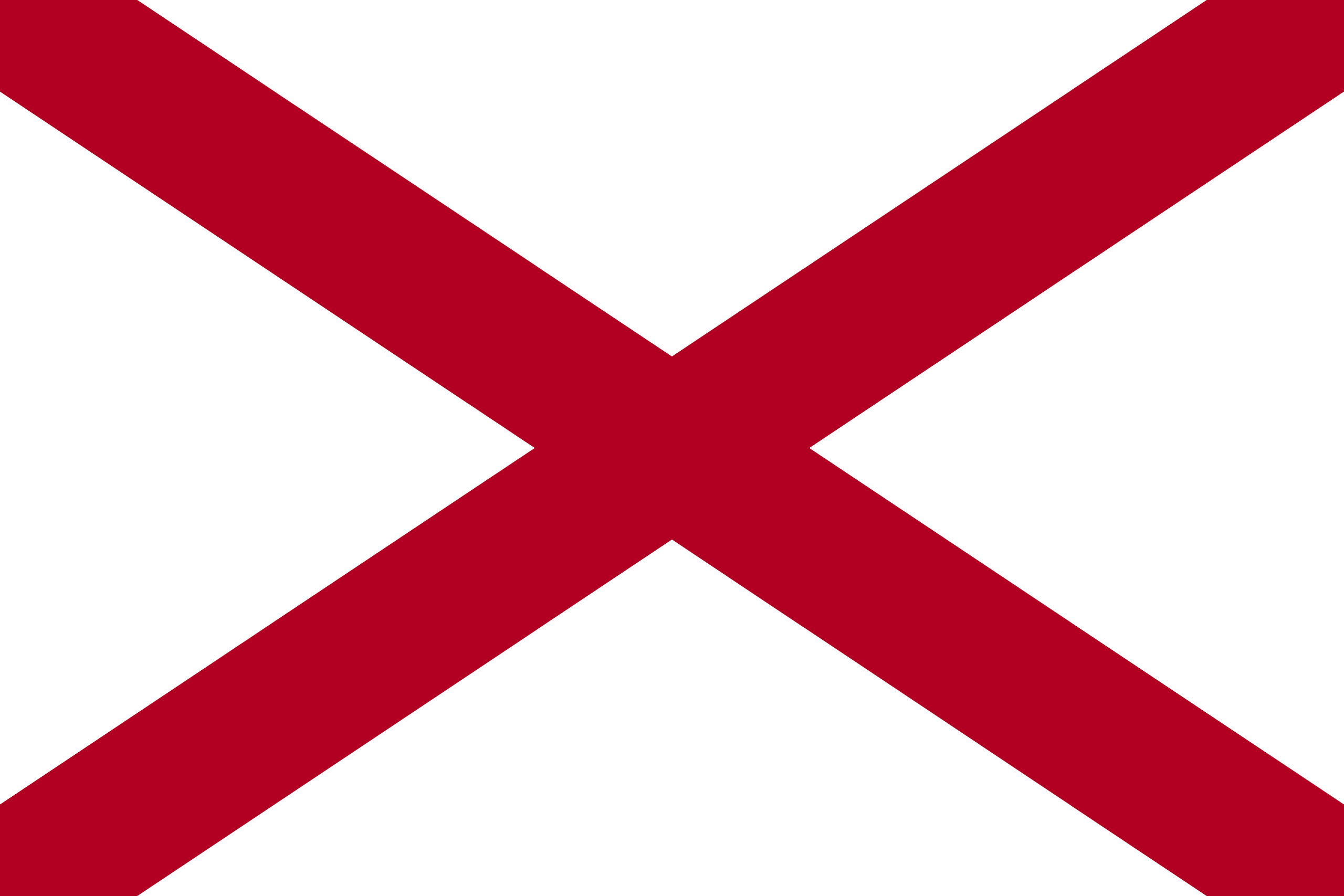

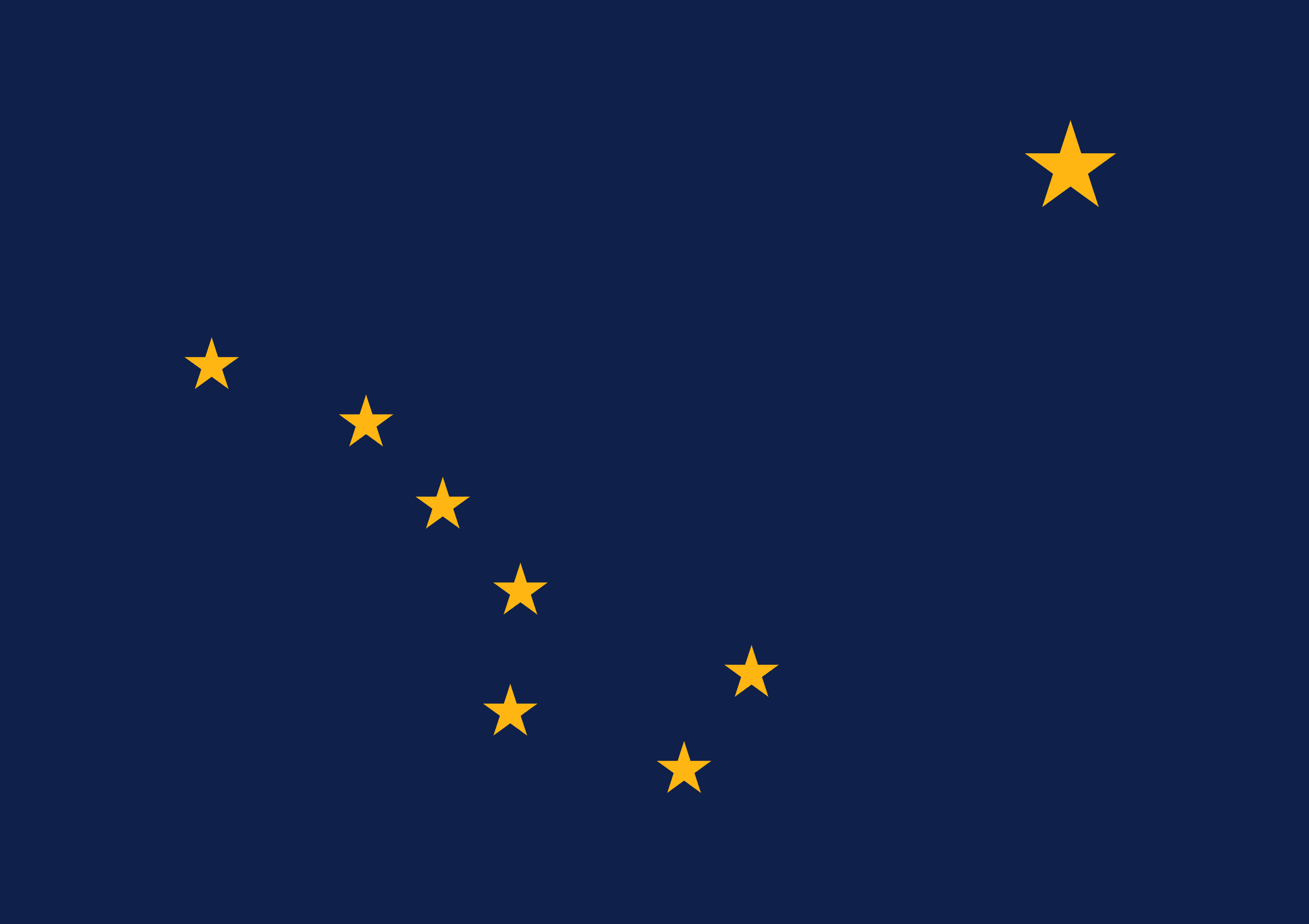

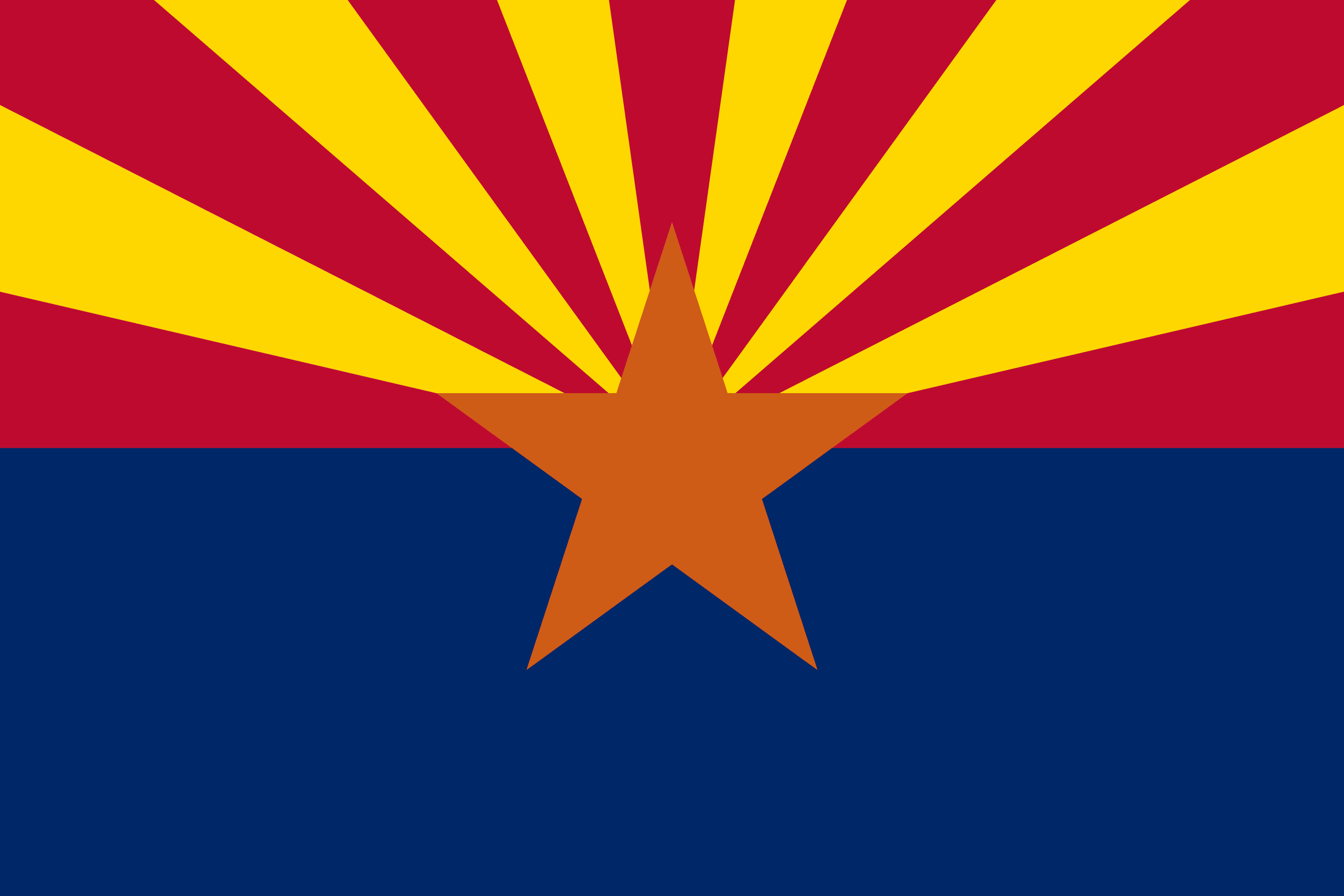

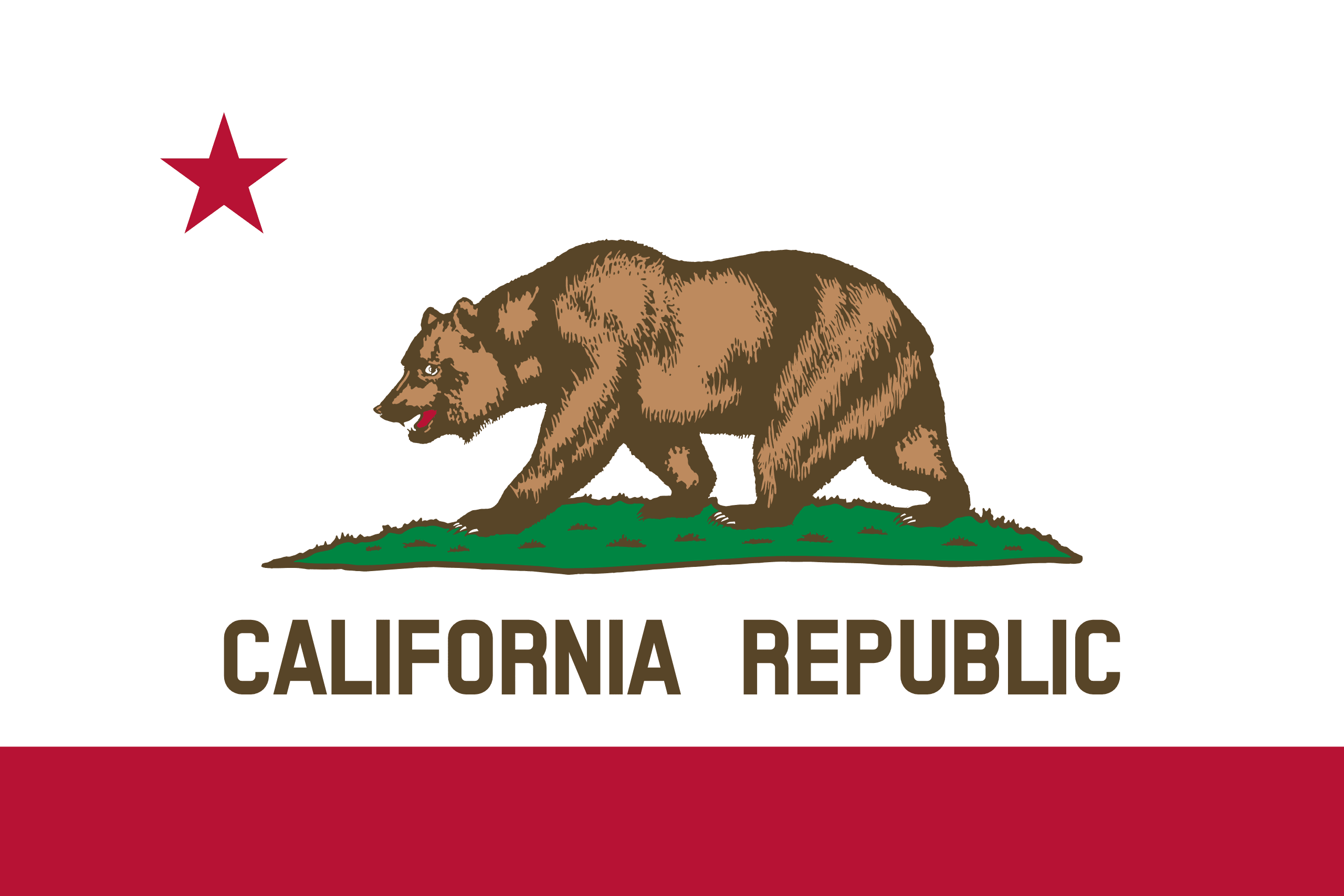

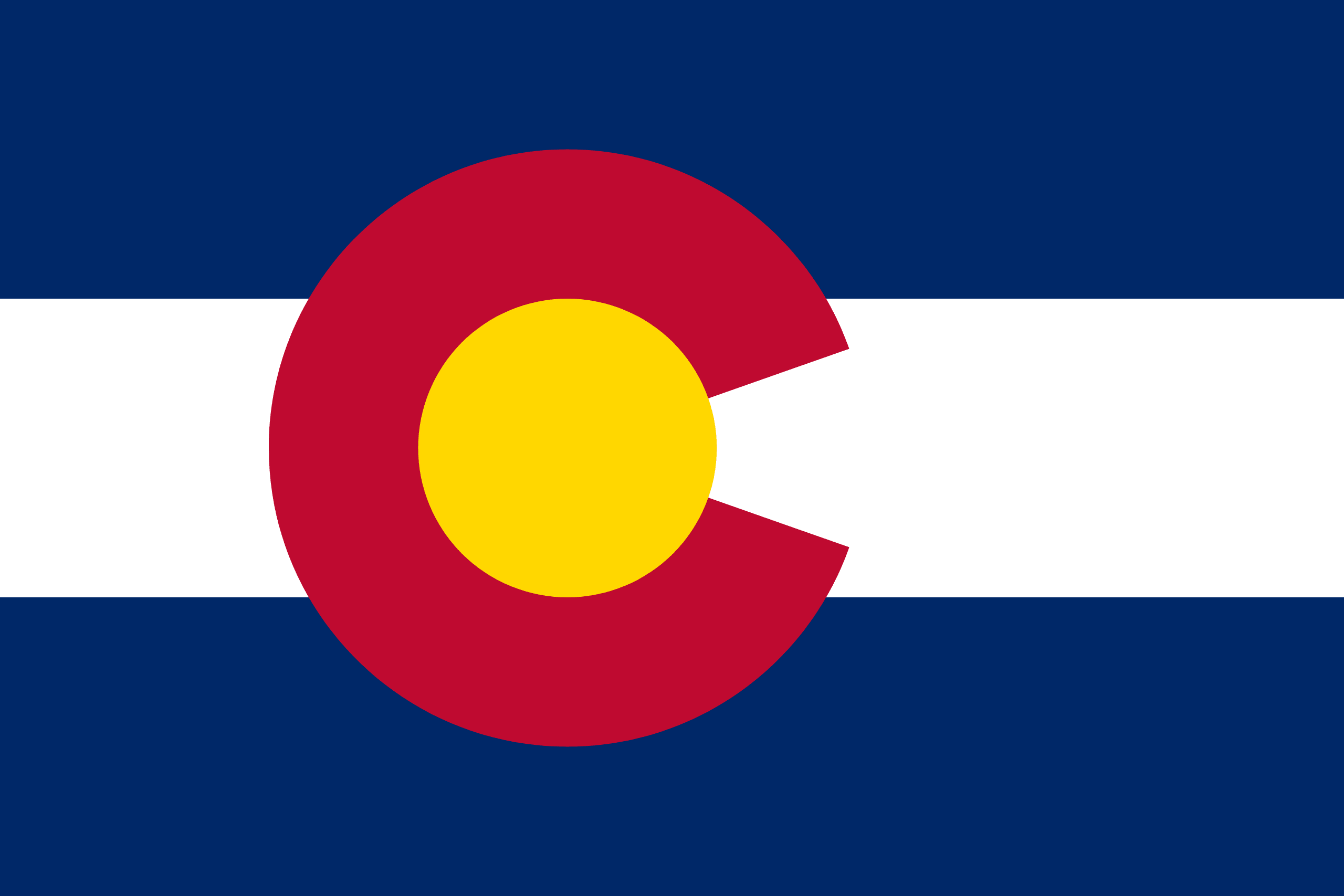

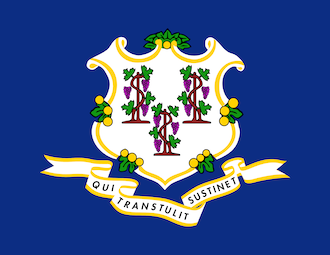

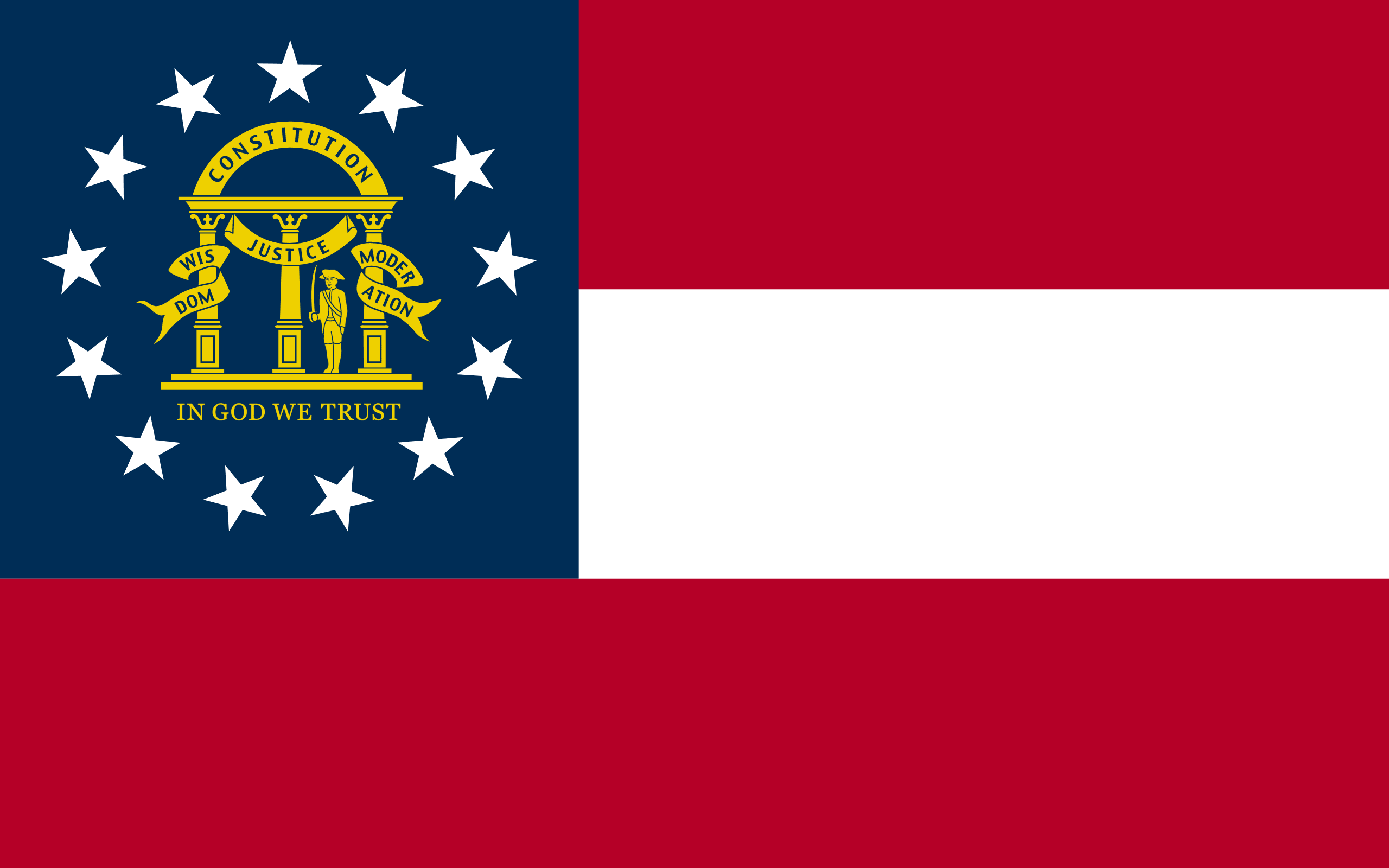

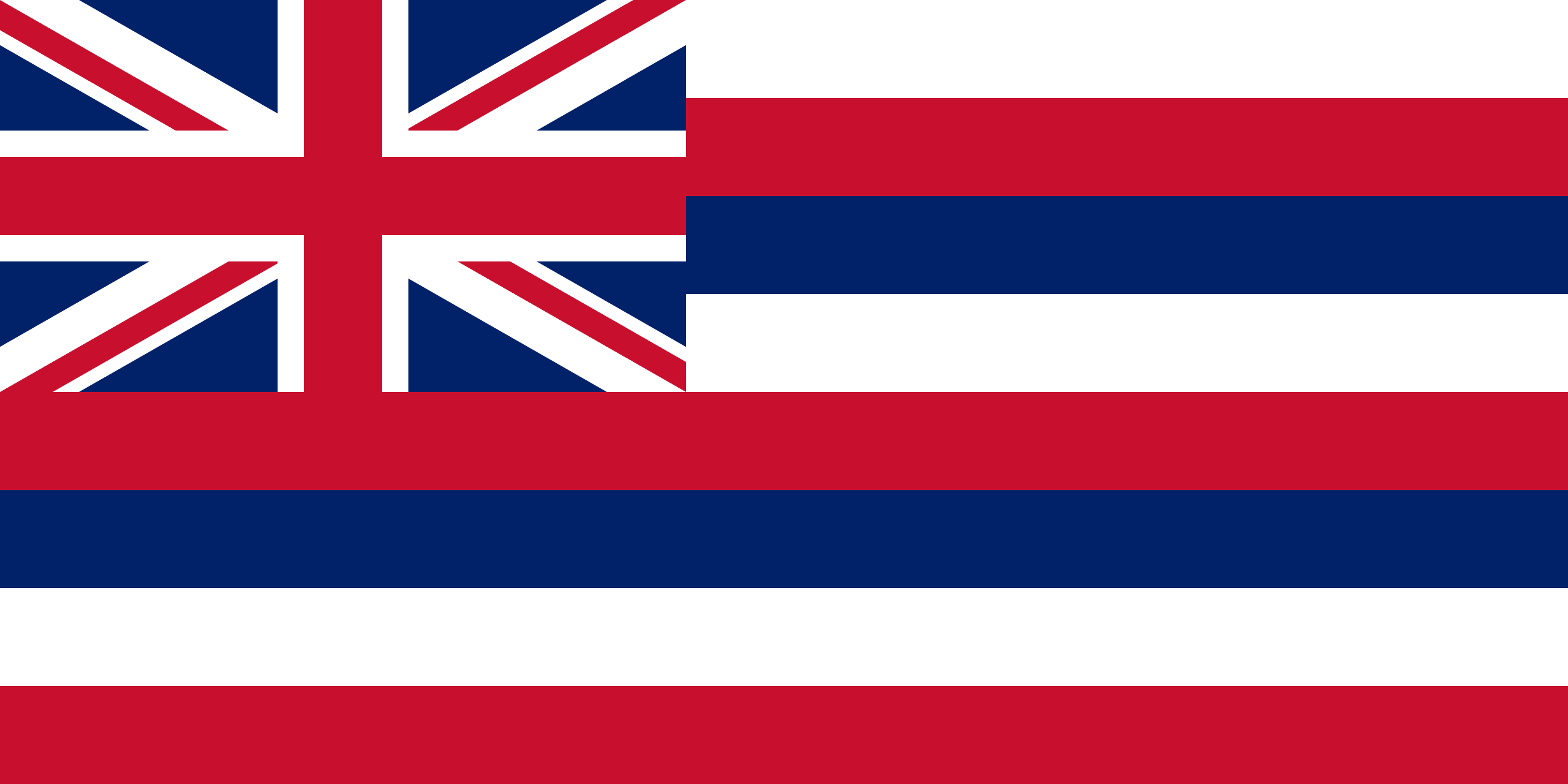

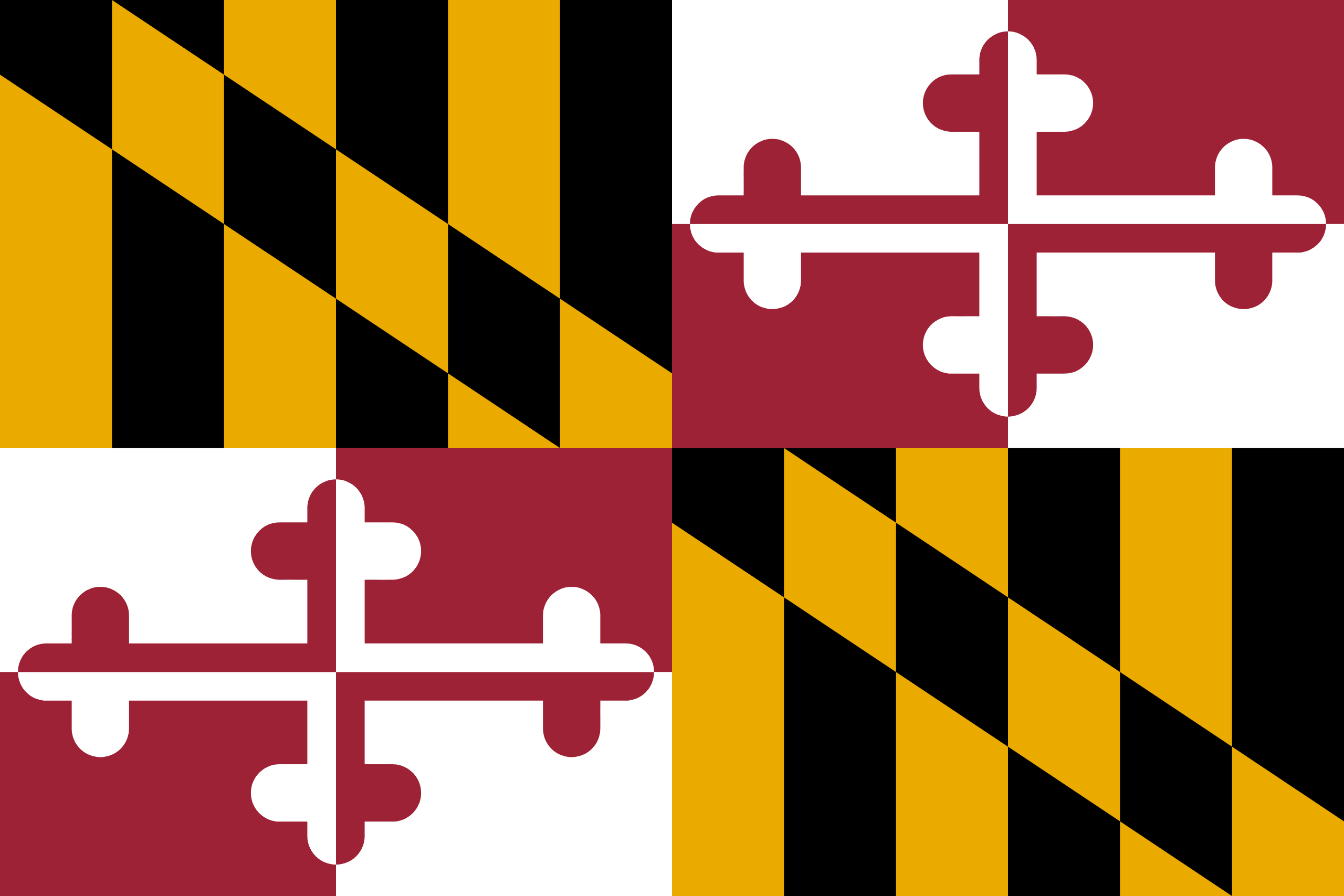

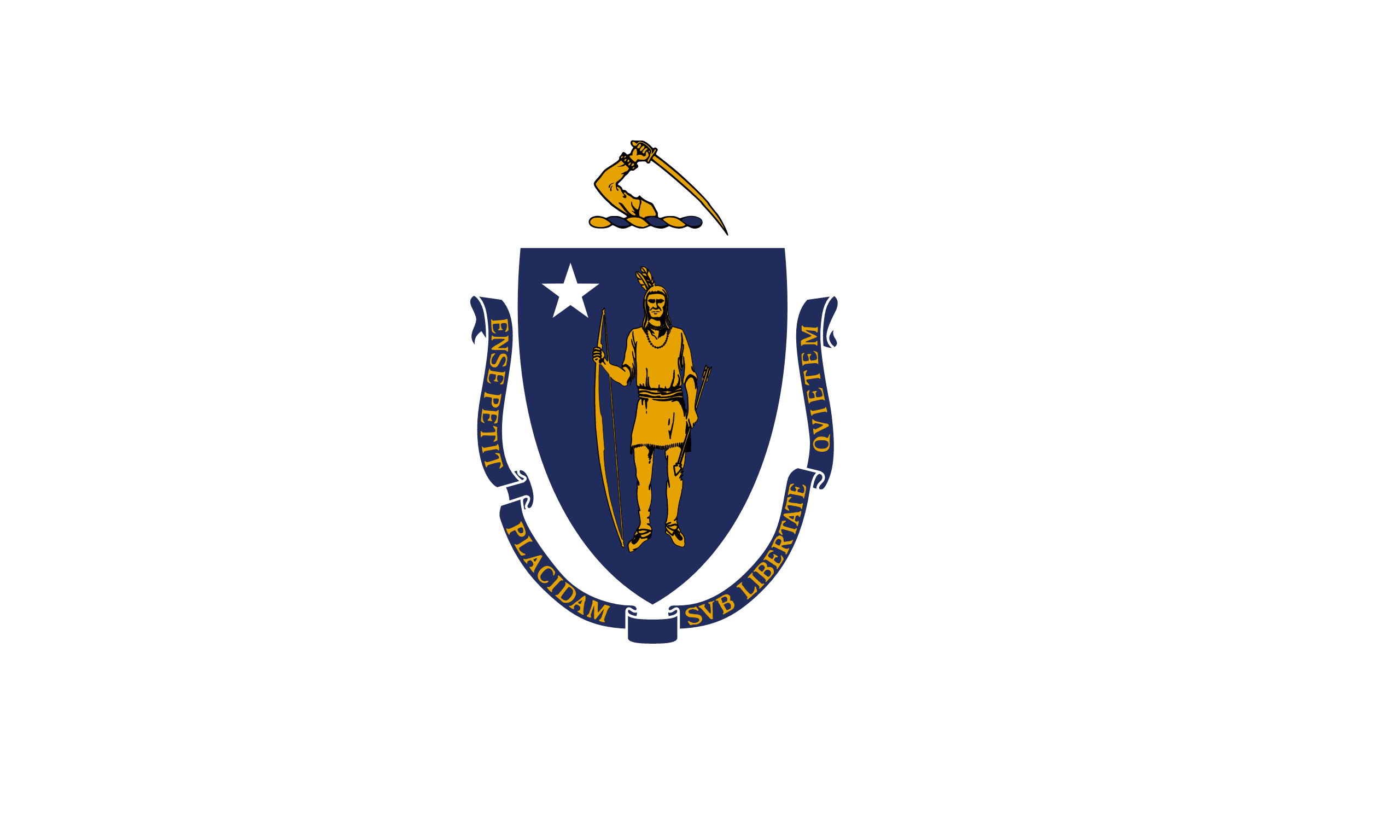

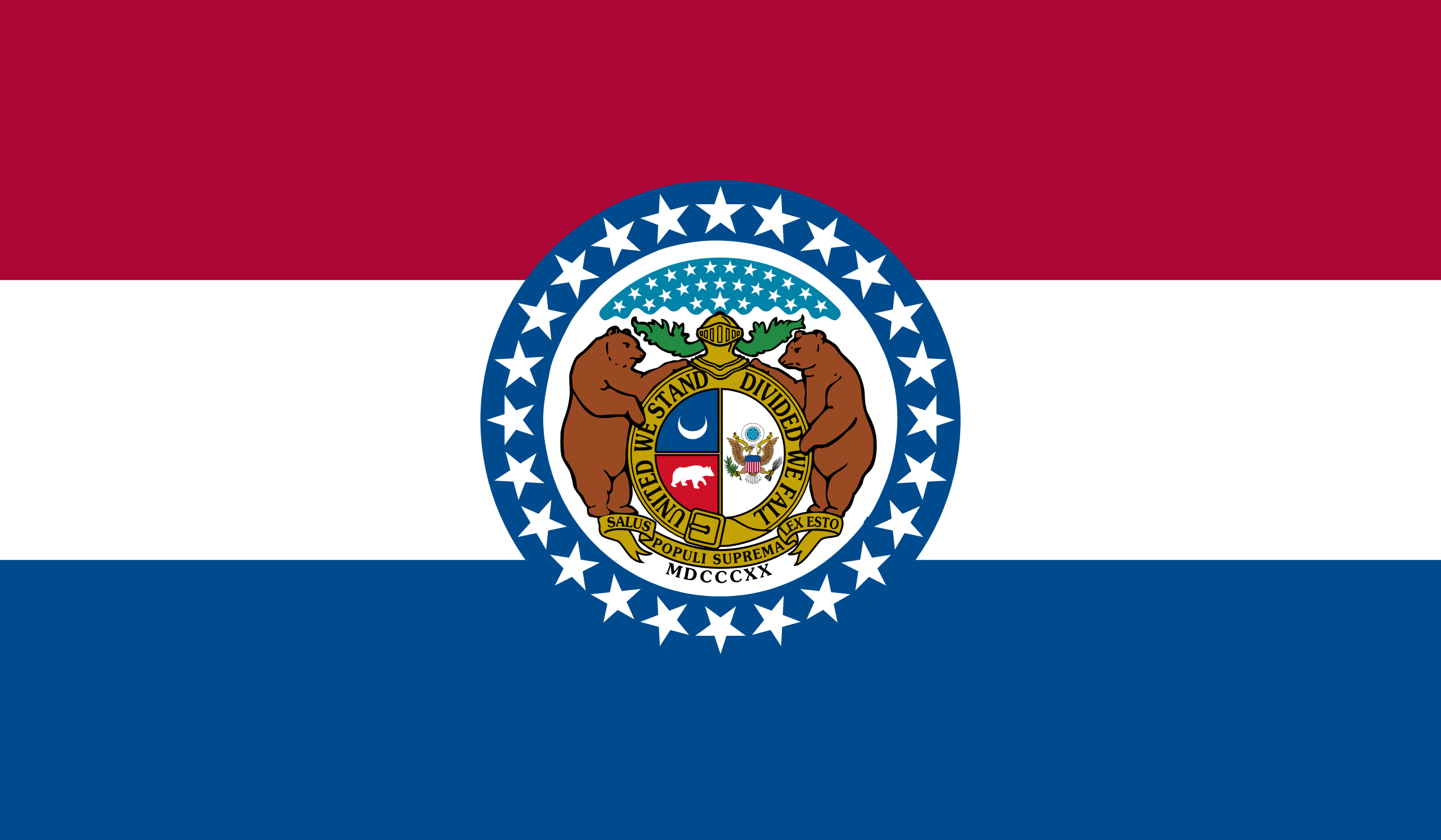

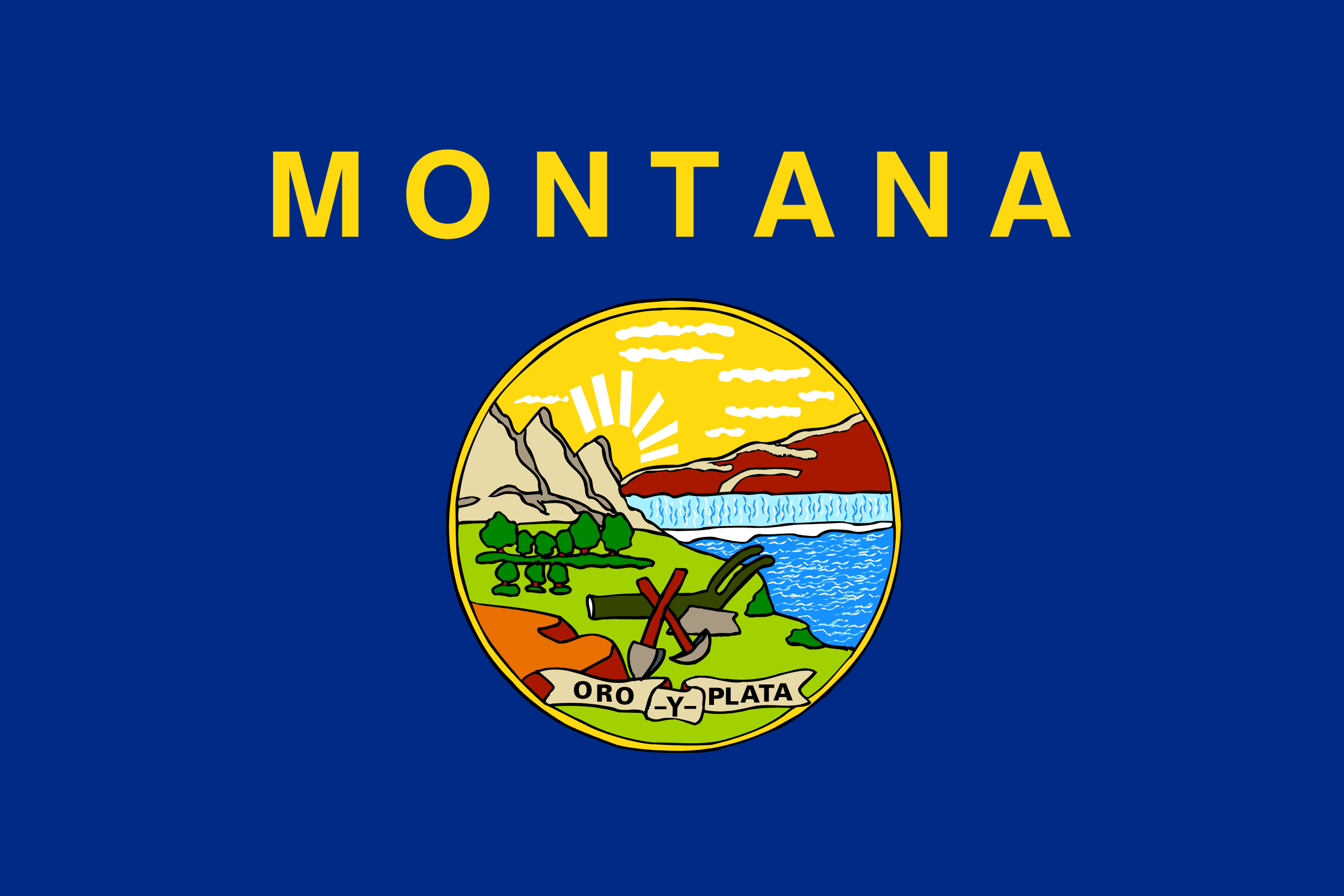

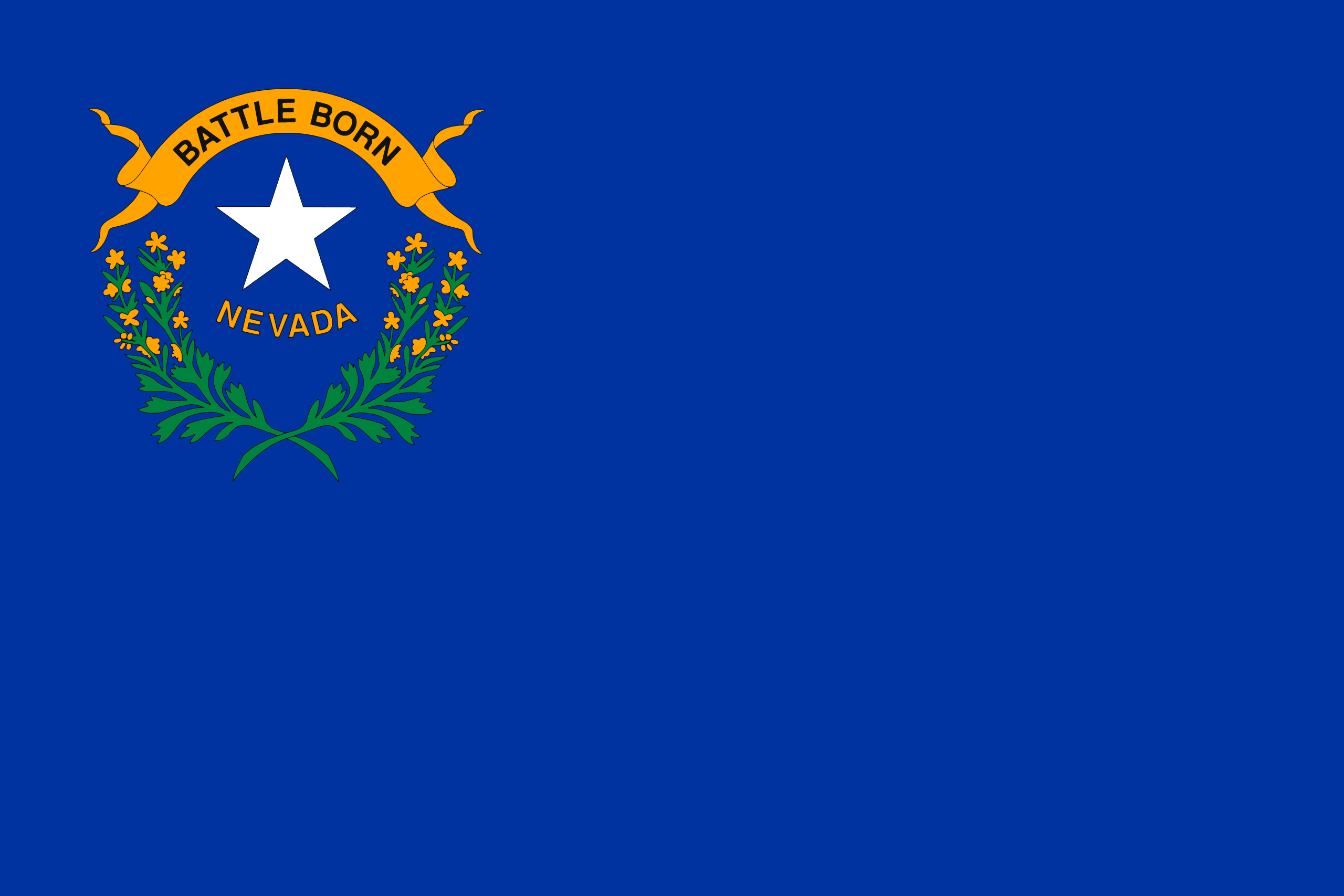

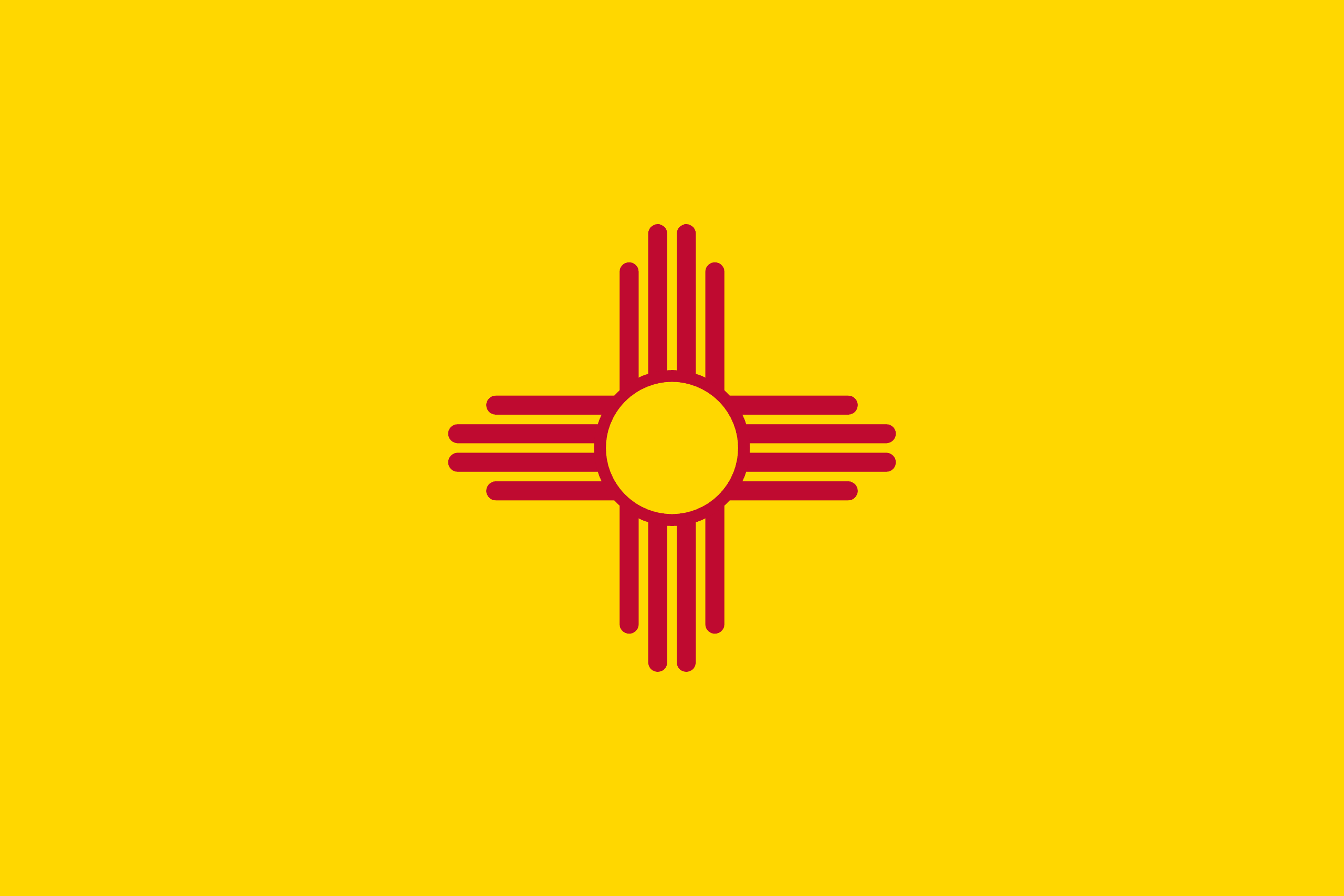

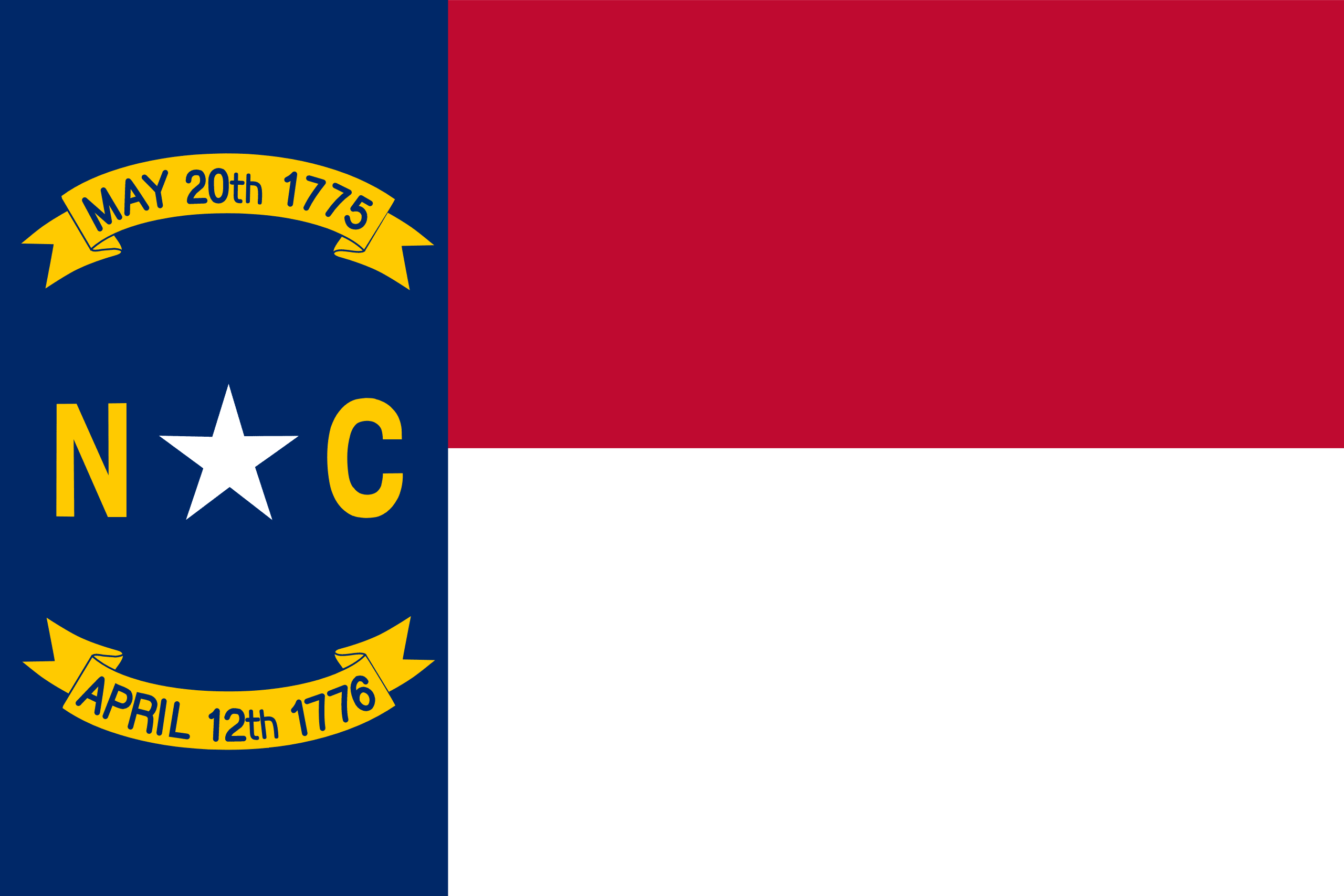

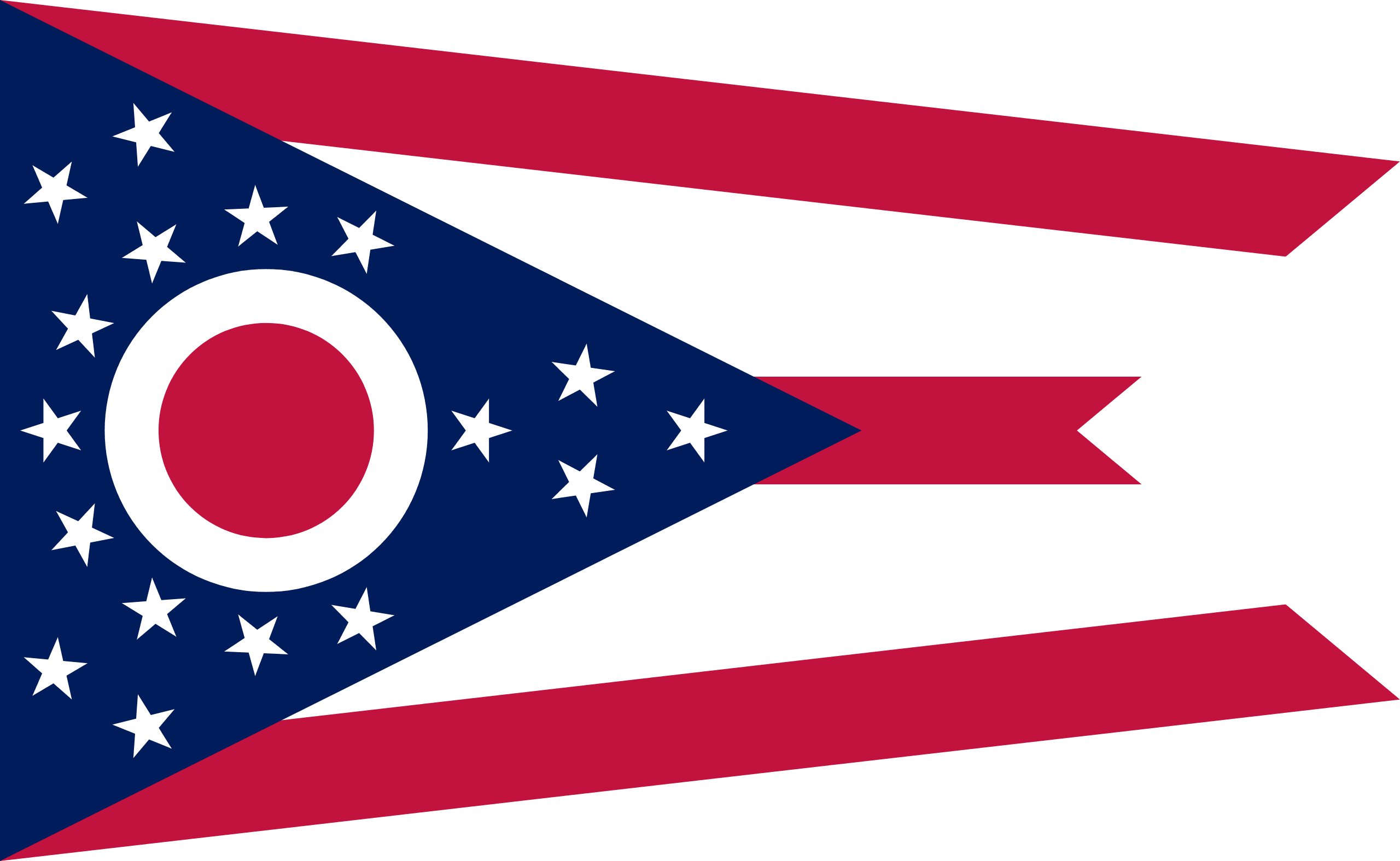

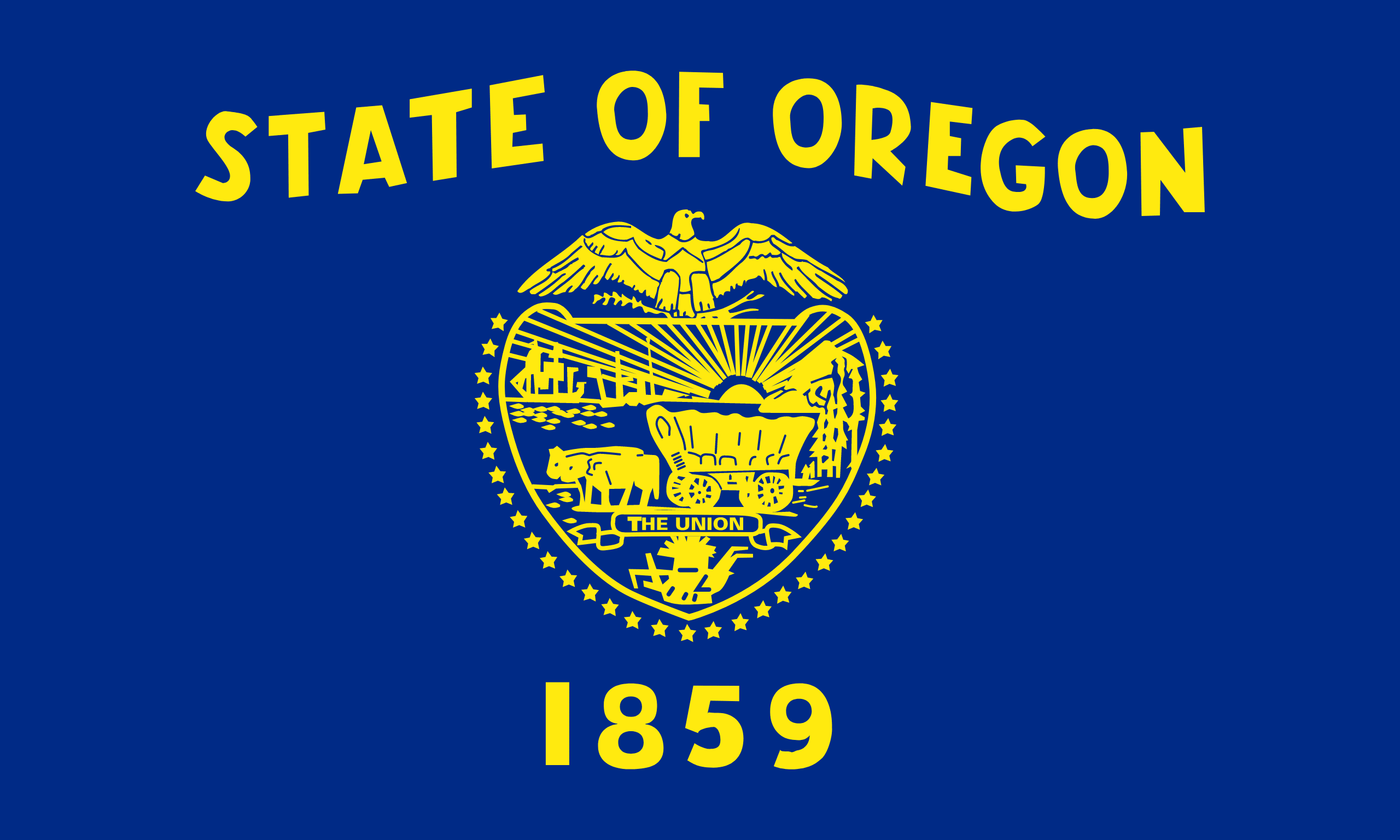

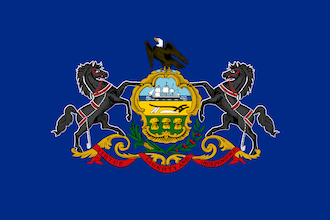

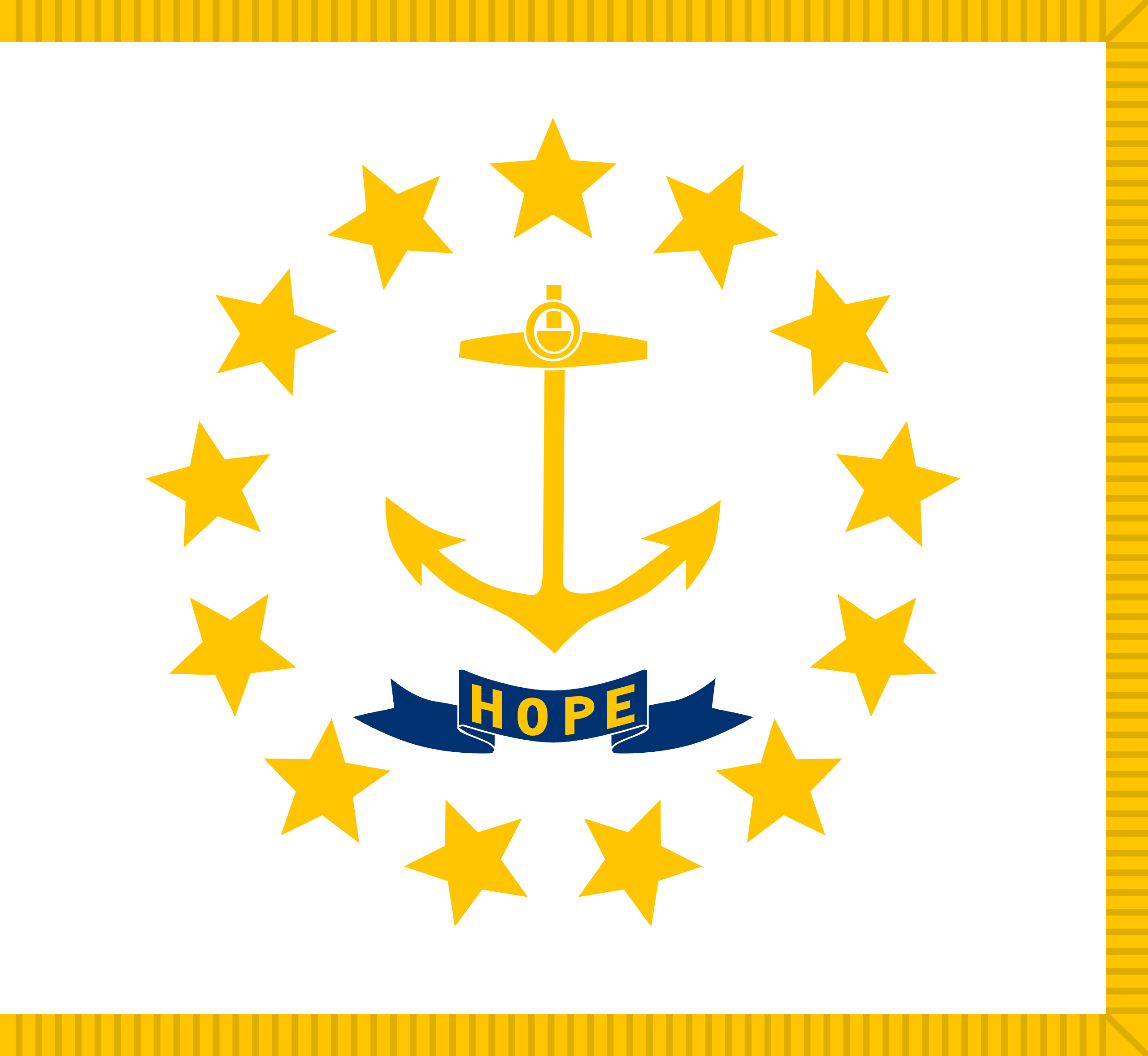

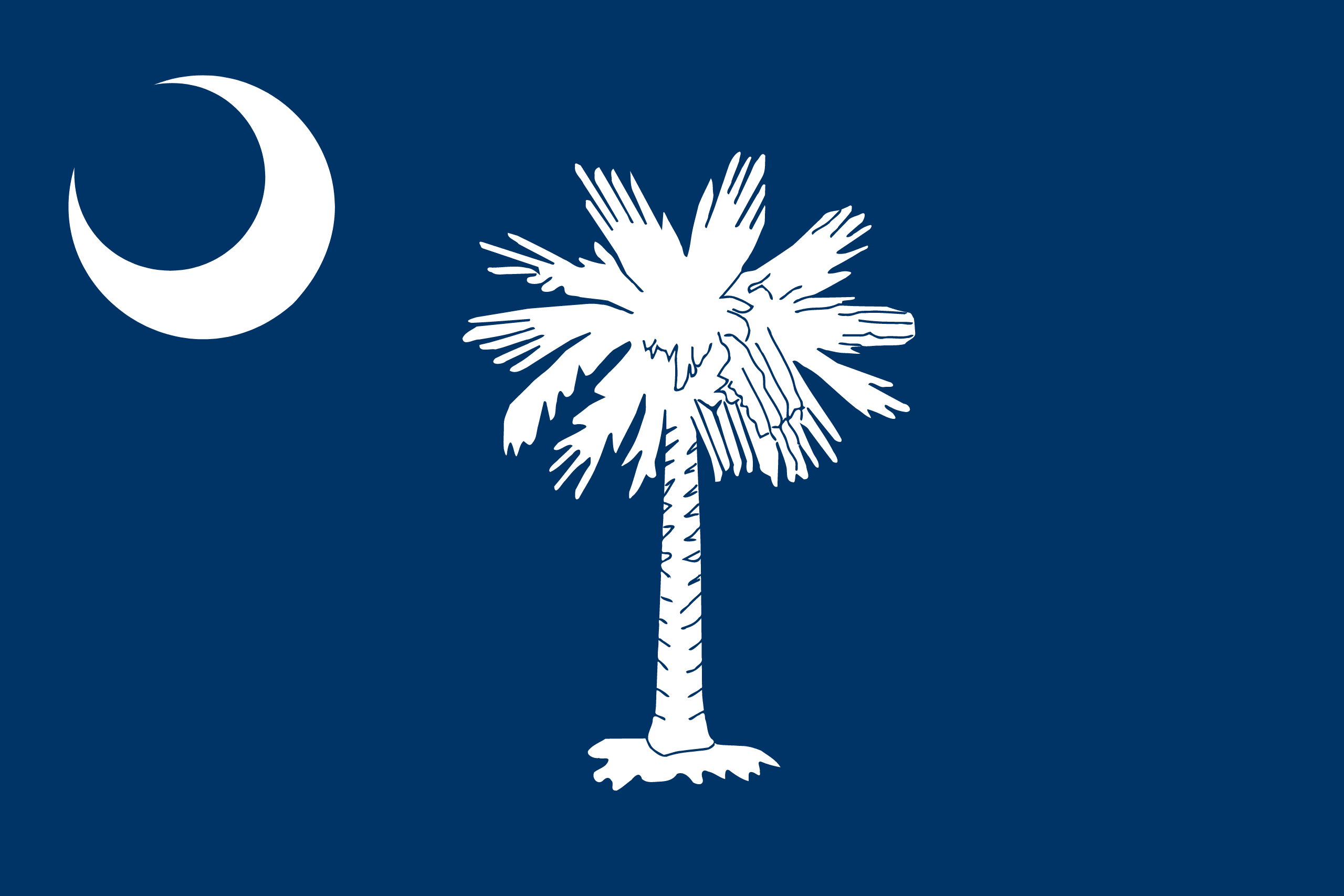

Property Tax Reduction By State

Calculate Your Property Tax

To calculate your property tax here is what you need...

- The assessed value of your property: This may or may not be the same as your property's market value, i.e. - the price you would expect to sell or buy your property. Usually each county's website (use the Search capability on this site) gives you the ability to look up the assessed property value based on address or parcel id.

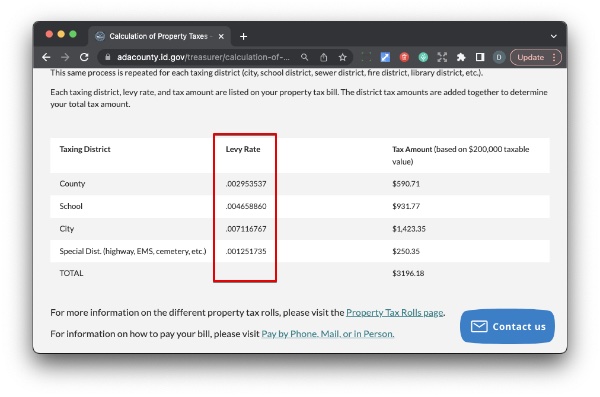

- The tax rate: You will typically find the tax rate on the local county assessor website. Often this is referred to as a levy rate. No guarantee that it will be easy to find. As an example, you can find the rate for Ada county Idaho at https://adacounty.id.gov/treasurer/calculation-of-property-taxes/. Added up the individual levy rates for county (0.002953537), school (0.004658860), city (0.007116767), and Special Dist. (highway, EMS, cemetery, etc.) (0.001251735) gives a total tax rate of ~1.60% - or more exactly 1.5980899%.

- Any exemptions or deductions: Some properties may be eligible for exemptions or deductions that reduce the amount of tax that is owed. Guess who you can contact about that? You can find that appropriate contact by using the Search capability of this site looking for the county of interest and getting the county assessor's website. From there it is a click of a link to get the contact information.

To calculate the property tax, you will need to multiply the assessed value of your property by the tax rate, and then subtract any exemptions or deductions.

As an example, if the assessed value of your property is $600,000 and the tax rate is 1.1%, the property tax would be $6,600 ($600,000 x 1.1%). If you are eligible for a $1500 exemption, the property tax would be $5,100 ($6,600 - $1,500).

Your Property Tax

Lower Property Tax Benefits

There are several reasons why property taxes may be lowered.

- Make housing more affordable: It becomes more difficult to afford a home if taxes are higher. Lowering property taxes can make it easier for people to afford to buy real estate, which can help to increase home ownership rates and promote stability in the local housing market.

- Stimulate economic growth: Lower taxes are attractive to businesses and can help incentivize locating in a particular area. With more business typically comes more employment opportunities.

- Encourage property maintenance: High taxes on property can discourage homeowners from making improvements to their homes or maintaining their properties, as they may not be able to afford the additional tax burden. Lowering property taxes can encourage homeowners to invest in their properties and maintain them properly, which can help to improve the overall appearance and value of a community.

Reasons Not To Lower Property Taxes

Local governments typical rely heavily on property taxes to pay for roads, police departments, fire and emergency medical services, schools as well as other services.

- Reduced government revenue: Depending on your perspective, this may or may not be a bad thing. Local governments rely on property taxes to fund a number of services.

- Decreased incentives for property improvements: There is less incentive to make property improvements if that results in higher property taxes. With that said, there are counties and municipalities that have laws in place to limit the amount that taxes are allowed to rise on housing.