About

This site is about reducing your Unites States property taxes.

Who we are

We are not appraisers, assessors, treasurers, county clerks, real estate agents, lawyers.

We are a team of 6 people... with an itch that needed to be scratched.

Beginning

One person on the team asked "how can I reduce my property tax"?

The response was: "Google it".

That didn't yield anything directly useful.

Instead that sent us down the rabbit hole of more googling looking for county assessor's, county clerks, phone numbers, fax numbers, board of equalization, forms to fill out, deadlines to met, appeals, uspap...

What makes it challenging to figure out how to reduce your property taxes is that there is not consistency from state to state or county to county on how to do so.

In general, reducing your property taxes is the result of reducing the assessed value of your property.

To reduce your assessed value typically starts with "call your county assessor".

If that conversation does not end satisfactorily, the next step is to file an appeal.

This is where it gets tricky.

Each county typically has their own specific procedures to follow. And usually there is a certain time frame when an appeal can be filed.

If your appeal is accepted, you will usually meet with the "Board of Equalization" to hear your case.

You can typically bring someone to represent you and your interests. Note that some municipalities or counties will require your representative to have written permission to represent your interests. Some will even require you to disclose if your representative is being compensated on a contingency basis.

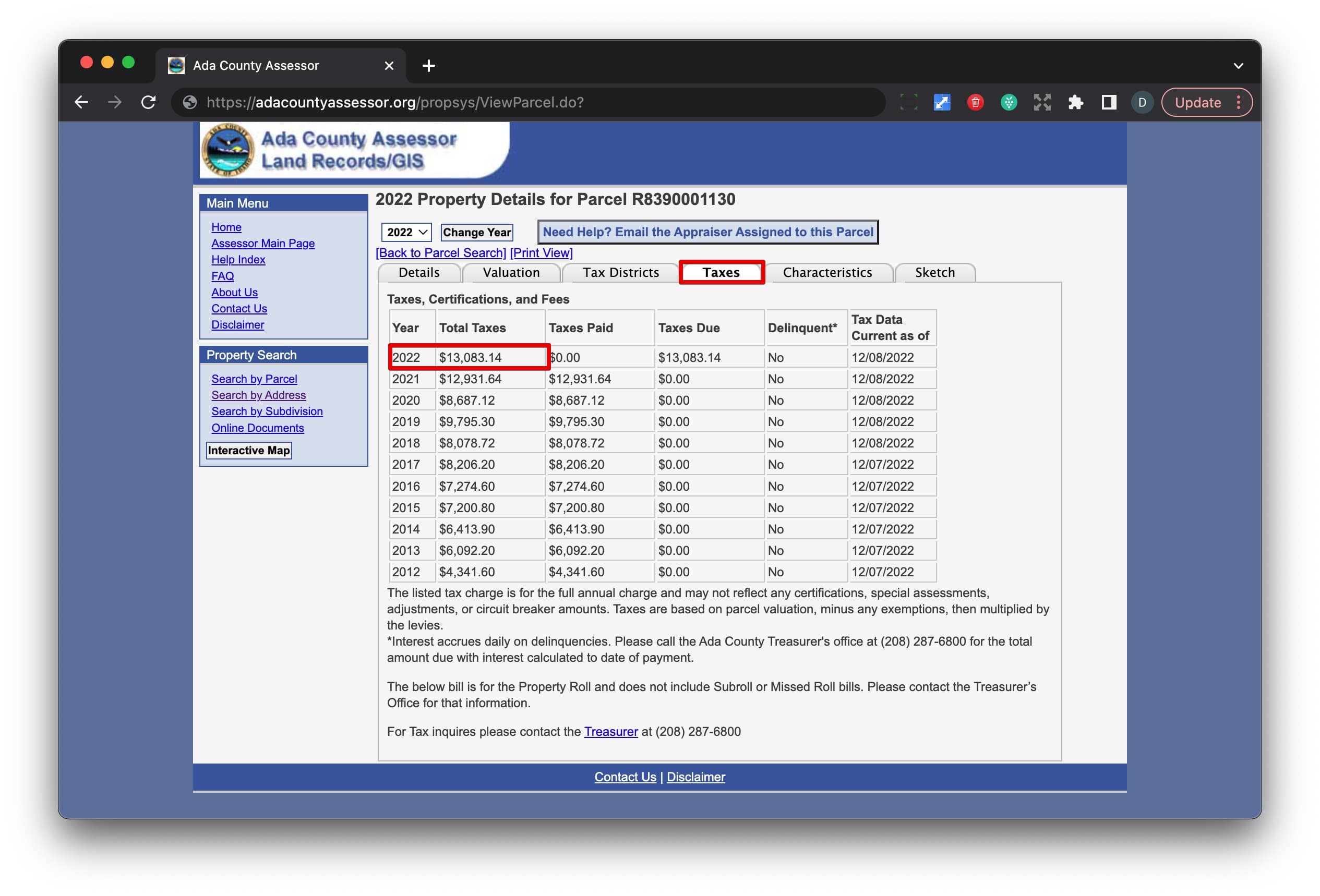

For your appeal, bring supporting documentation for why you think your property assessed value is to high. One of the strongest pieces of documentation you can bring is the taxes for comparable properties.

As an example, consider that you find a similar sized property / home in your neighborhood. A search of the county's land records/GIS will typically show the taxes. Is this comparable to yours? If not, consider investigating before you use this in your appeal. Did the home recently get updated? Does it have a feature that yours does not, ex - 2 car garage with apartment above? Regardless, this is the type of research you will want to do.

How to use this site

Use the Search feature at the top of this page.

Provide your city, zip code, or county and search.

Alternatively, start from the home page and click through to your state, then your county.

What you will find is useful information to help with reducing your property taxes for each county in the United States. Information includes:

- County website

- County phone number - typically the general contact phone or the county clerk phone

- Fax (if they still have one)

- County assessor's website

- Step by step instructions to reduce your property's assessed value <<< IF we could find it

- Property tax reduction strategies

- County median home values and how it compares to other counties in the state and compared to the US median home value

- County median household income compared to the state and United States

- County population growth from 1990 - 2020: raw and percentage compared to state and United States

- Cities in the county

- Zip codes in the county

- Counties in the state

- States in the United States